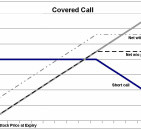

A covered call is an options strategy where the investor holds his position in an asset (long position), and shorts a call option (sells call option) simultaneously. This is an attempt from the investor to gain additional income from the asset when he speculates the asset will remain neutral for the short term. The investor gains the premium from the short sale, and has the assets to COVER his position in case his expectations are wrong.

Two outcomes are possible from this strategy, ceritus paribus. 1.) The assets price remains stagnant below the strike price, or falls. You receive the premium and the option isn't exercised, you win. 2.) The assets price goes above the strike price. You keep the premium, and the difference between the strike price and what your asset was worth at the time of short sale. Yes, you under-performed the asset, but you didn't lose any money.

- Part of Speech: noun

- Industry/Domain: Financial services

- Category: Stocks & securities

Other terms in this blossary

Creator

- Timmwilson

- 100% positive feedback

(Beijing, China)